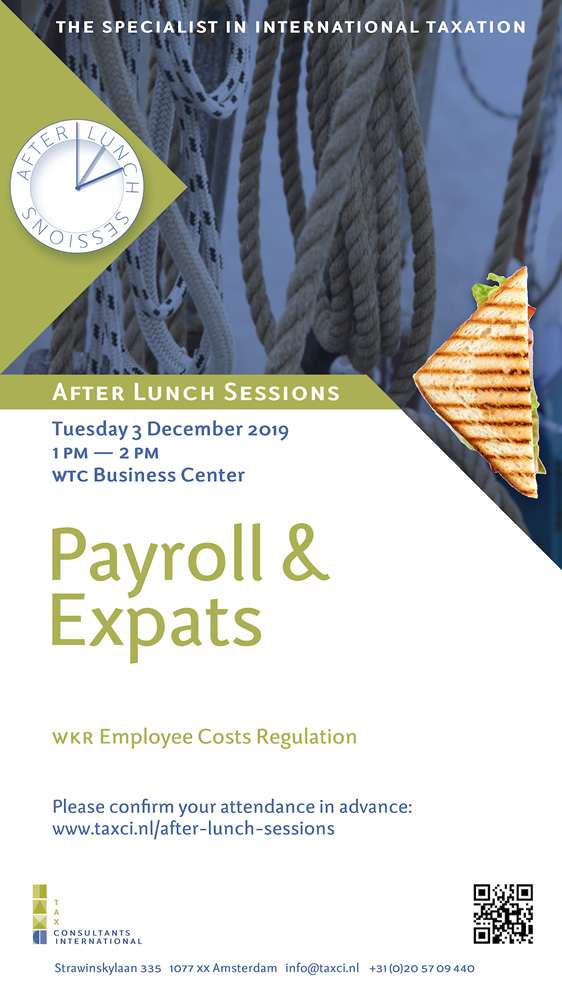

After Lunch Session - 3 December 2019: WKR – Employee Costs Regulation

On Tuesday 3 December 2019, you are most welcome again in the WTC Amsterdam to attend one of our After Lunch Sessions, this time about the WKR – Employee Costs Regulation, the Dutch tax arrangement for the taxation or exemption of employee related costs, expenses and benefits.

In the wage tax return over the first wage tax period to be filed by the end of February every year (announced to be changed to second wage tax period, and thus due date in March), a Dutch employer must make the legally required notification of excessive employee expenses to the tax office on the basis of the so-called Employee Cost Regulation or "WKR" (werkkostenregeling). During this session we will elaborate on the exact filing obligations for the WKR and the best practice for execution before year end to avoid/ limit the 80% tax charge over excessive employee expenses.

After the presentation there is an opportunity to ask questions and to get to know our consultants personally. The presentation is given in the English language.

Registration

If you want to participate in this session (and other TAXci sessions), you can freely register for this at the registration page on our website.

If you have any questions or comments, please contact us by e-mail or call us at +31-20-5709440 (Amsterdam) or +31-10-2010466 (Rotterdam).